By: Cameron Annas, Granite Insurance

Let me start out by saying this is a technical article. This article is not meant to be memorized or applied. As you work through this information, it is important that you not over burden yourself with the details. Read with the intention of understanding the broader concepts in order to gain a better understanding of how your agent or broker can help you manage employee injuries to control your workers compensation premiums.

EFFECT ON WORKERS COMPENSATION PREMIUMS

Did you know that you have direct control over your workers compensation premiums? Before we begin this discussion, there are a couple important terms for you to know:

- Experience Modification Factor: The single most important factor that determines your workers compensation insurance costs. It is based off your most recent 3 years of workers compensation losses, excluding the most immediate policy year. (2016 experience mod would take into account years 2012, 2013 & 2014) If you have a 0.75 experience mod then your workers compensation premium is multiplied by 0.75 (giving you a 25% discount). If you have a 1.25 experience mod, your workers compensation premium is multiplied by 1.25 (giving you a 25% surcharge). Obviously, the lower you experience mod the better. Do you know what your minimum experience mod is?

- Claims Costs: There are two different types of claims costs; medical expenses and indemnity (lost time wages, temporary/permanent disability and other costs besides medical). This is VERY important to understand as you progress through this article. Fully understanding claims costs can keep your workers compensation premiums down by tens of thousands of dollars.

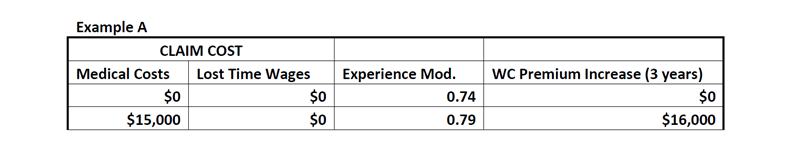

- Your experience mod is the single most important factor to control your workers compensation costs. Did you know that when workers compensation claims are limited to “medial only” you get a 70% reduction when that claim is applied to your experience mod? As soon as the first dollar of indemnity expense is paid, you lose that 70% discount. Take a look at Example A.

This particular company pays an estimated $80,000 in workers compensation and has a 0.74 experience mod (loss free experience mod for them). Let’s say they have one claim. This $15,000 claim is limited to medical expenses only. In the second row of Example A, you can see the effect on their experience mod taking them from a 0.74 to 0.79. Over three years, the increase on their workers compensation premiums will be $16,000. Remember, because this claim was limited to medical expenses only, the claim received a 70% discount when it was applied to the experience mod.

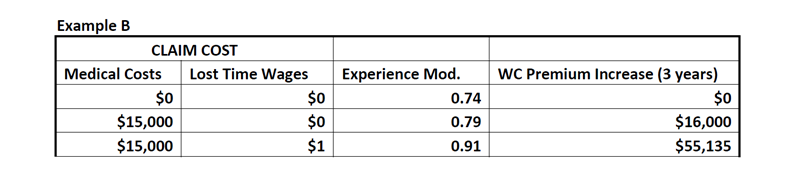

Now let’s say the employee is out of work for a couple of days longer than the waiting period in your state (usually 3 or 7 days depending on the state). Then the injured employee would begin collecting lost time wages (which is an indemnity expense rather than a medical expense). If $1 is paid toward the indemnity expenses then you lose the 70% loss credit on your experience mod. Example B illustrates how this could affect your workers compensation premium. In row two you will see the medical only example, and in row three you will see the impact when you add $1 of indemnity expense (lost time wages) to this scenario. In this type of scenario, $1 in lost time wages could cost your company over $39,000 in extra workers compensation premiums!

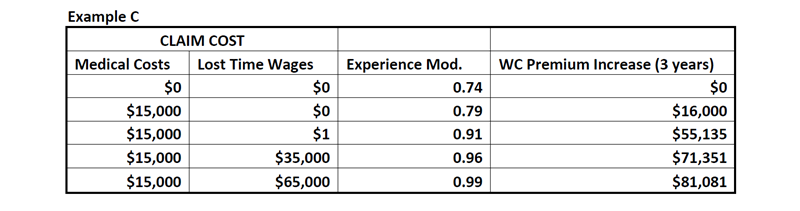

In Example C you will see what happens as the lost time wages (indemnity expenses) continue to increase. You will notice the experience mod does not drastically increase as the lost time wages increase. The first dollar of lost time wages results in the most dramatic increase because you lose the 70% discount when the loss is applied to the experience mod.

HOW CAN I PREVENT AND MANAGE LOST TIME WAGES

When managing your experience mod and workers compensation premiums, there are two very important elements to consider.

- Medical Provider Selection. If your state allows you, your company should have a pre-selected medical provider for your employee injuries. This medical provider should be familiar with your operation and job descriptions. The last thing you want is the employee going to a “friend” that is a doctor and asking the doctor to keep them at home and out of work as long as possible. This type of scenario will cause your workers compensation premiums to rise dramatically. The medical provider should know that it is extremely important for you to get your employee back to work in a light duty program (described below) as soon as possible.

- Light Duty Program. If your employee cannot do their normal job (being a guide) how can we get them back to work quickly so that we do not activate the “lost time wages” requirement and lose the 70% discount on the claim? A light duty program is a great way to clear this hurdle!The first step is to figure out how long the waiting period is for lost time wages to be activated in your state. Is it 3 days? 7 days? Whatever it is, the employee needs to be in a light duty program before missing this number of work days. By getting the employee back to work inside this window, we can prevent the lost time wages requirement from being activated, which would automatically result in the loss of the 70% discount that is applied when the claim is limited to medical expenses.

Can the employee help out in the office, at the reservations desk, or in another light duty job function? If so, we want to get them doing this instead of sitting at home collecting the workers compensation payment! This arrangement will help boost the employee’s morale and encourage them to recover so they can get back to their primary job responsibilities. (We all know most employees that are guides hate being in the office!)

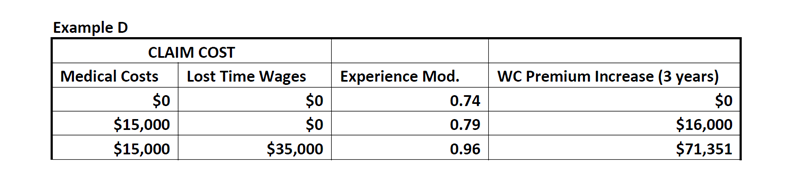

Take a look at Example D. In the last row, the employer allowed the employee to go home and collect lost time wages under workers compensation instead of implementing a light duty program.

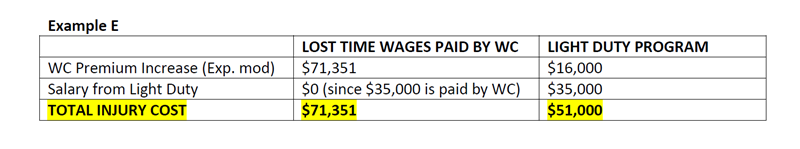

What if they would have implemented a light duty program, and had this worker assume a light duty position collecting salary instead of lost time wages? Take a few seconds to review Example E. Just by having a light duty program in place, this company would have saved $20,000 . That’s incentive!

About the Author:

This is all very technical information! Granite Insurance is here to assist you with these technical risk management and insurance matters. It is not your job to know all of this, or even to be able to implement any of these safeguards without expert guidance. At Granite Insurance, it is our mission to help you navigate these stressful scenarios to help ensure your success.

For more information, contact Cameron Annas, Adventure Sport Risk Consultant.

Email: cannas@graniteinsurance.com

Phone: 828-212-4552

Website: https://www.graniteinsurance.com/