By: Ruthie Lile, Granite Insurance

Insurance can be a very confusing world for anyone who doesn’t spend their day to day dedicated to mastering it. That’s why you have an agent! Most adventure operators (I say most because I know some of you out there like to nerd out) just have a base level of understanding of their insurance program, and most insurance carriers just have a base level of understanding of what goes on at an adventure tourism operation. Your agent is necessary to bridge that massive gap, and it is their role to play educator to both sides and to inform you, as the operator, of your risk exposures and what insurance tweaks or policies are available to cover those exposures.

Agents provide insight and support, allowing you to prioritize spending and choose what and where you want to have insurance coverage. Sometimes, your program hasn’t been reviewed in so long that you are paying for coverages that don’t really make sense for your operation anymore. Sometimes, more often than you’d think, there are coverage loopholes in your program leaving you exposed where you didn’t realize you were exposed. We call these unintentional loopholes “landmines” because they could be financially devastating if accidentally triggered by the right type of uncovered claim. And sometimes, without even changing anything in your program, there are opportunities to save money! This article will take a magnifying glass to one of these common easy savings opportunities. We’re going to focus in specifically on your Worker’s Compensation (WC) policy and what happens when one of your employees gets injured on the job.

WC Basics

Before we dive in too deep, let’s first review a few basics about your WC policy:

-

WC laws vary by your state. Each state has it’s own laws and intricacies, but most states will require businesses to have WC coverage in place.

-

WC is meant to be an exclusive remedy for an employee’s on-the-job injuries, and in most states as long as an employee is receiving benefits from your WC policy they cannot sue their employer for work-related injuries. WC is a compromise! It gives employers immunity from lawsuits in exchange for coverage of an employee’s medical costs, missed work opportunities, and other injury-related expenses.

-

WC premium is based on your payroll projections. If you have a higher payroll estimate, you will have a higher premium. And vice versa. And then you get audited at the end of your policy period – if you ended up with higher payroll than your initial projection, you will owe additional premium. If you had lower payroll than your initial projection, you should receive a partial refund.

-

One of the other things your WC premium is based off of is the category of risk of your employee’s job duties. A guide for a whitewater rafting company is exposed to more risk of injury than a librarian, right?! These categories of risk are called “class codes”. And most of your employees in an adventure tourism operation are going to be classed as 9180, but again – this will vary by your state and by your employee’s job duties. Different employees who perform different job functions from eachother might be split into a few different class codes, but one employee does not get assigned multiple class codes.

-

Class codes have corresponding rates depending on your location. These rates fluctuate annually, and can also fluctuate depending on the market your agent has been able to place you with.

-

Payroll projections and class codes aren’t the only things your WC premium is based on. It’s a complicated equation with many other modifications to reach your final premium.

Getting Your “Manual Premium” (Before Other Modifications Occur)

Let’s pretend you are an operator in Colorado, and for the sake of ease let’s say that you have $500,000 in payroll and that all of your employees are classed 9180. As of 1/1/21, Colorado’s voluntary market rate for class code 9180 is 4.57. This value is expressed as “per $100 of payroll”, so when we multiply $500,000 by .0457 we get $22,850 as your WC “Manual Premium”. Other modifications apply to this manual premium before you get your Total Premium Due, but this is your starting place.

How Can I Control My WC Cost?

One of these other modifications is where we have some play room (in most US States, but not all), and it comes down to handling employee accidents the “right” way after they occur. “Right” means having a Return to Work Program in place:

-

Get a doctor’s note indicating what the injured employee can or cannot do

-

Before they miss 3 days of work, get your employee back to work! (This # of days varies state by state from 3-7. Find out what your state’s WC law says)

-

“Back to Work” for an injured employee can mean a modified role as appropriate – answering phones, making reservations, working on projects from home – whatever! Once healed and cleared medically, they can be put back to work in their normal capacity.

“But…why?” What a great question! “3 days” matters because it changes the category of claim it gets labeled as. All WC claims will get tagged as either indemnity or medical only. A claim will fall into the indemnity category if there is any disability pay or if there is any lost time pay. Lost time pay kicks in after those 3 missed work days. If you can keep a claim as medical only, meaning there is no disability payments and no lost time pay, the claim is reflected on your loss runs as having a 70% discount!

So – what was originally a $10,000 claim is seen as only $3,000!

Your Experience Mod

Now there’s this thing called your Experience Modification Factor, or your “Experience Mod”. It’s purpose is to gauge both your past cost of injuries and your future chances of injuries. To come up with your Experience Mod, there’s a calculation that utilizes 3 full years of past claims data, excluding the most recent year (since those claims probably haven’t been fully realized yet). So in 2021, your 2020 claims would be excluded and the Experience Mod calculation would use 2017, 2018 and 2019. When looking at the claims from these years, it’s looking at both the frequency and severity of those claims. The severity of these claims is indicated by the dollar amount that can be attributed to a claim – so if claims were kept as medically only, and reflected a 70% discount, the severity is 70% lower!

Because the calculation takes 3 full years of claims data, excluding the most recent year, your business won’t have an Experience Mod until you’ve been in business for a few years. There’s also a threshold per state, so if your WC premium isn’t high enough you won’t yet have an Experience Mod. But whether you have an Experience Mod yet or not, if you take the steps now to handle your claims the “right” way, you’re setting yourself up for success further down the road! That effort will show in the coming years as you grow in size and once you have a few seasons under your belt.

-

An average Experience Mod is 1.0.

-

0.8? Better than average!

-

1.2? There’s some work to do!

Here’s where everything really starts to come together. Your Experience Mod is used as a direct multiplier of your Manual Premium. Let’s continue our example from earlier, where our Manual Premium calculation came to $22,850

-

If your Experience Mod is .8 and your Manual Premium is $22,850

-

If your Experience Mod is 1.2 and your Manual Premium is $22,850

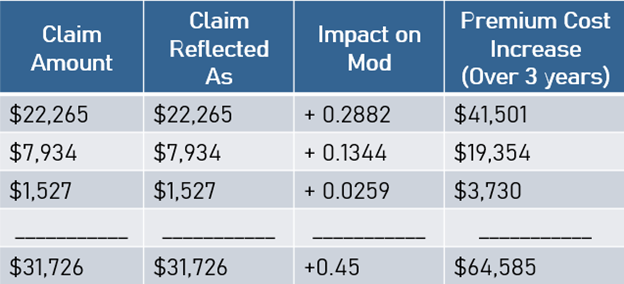

Woah! That’s a big difference in premium. Let’s take a look at a real-life example from one of our clients. This top table shows what would happen if all WC claims were Indemnity. It shows that over the course of 3 years, the total premium cost increase for these claims was an additional $64,585:

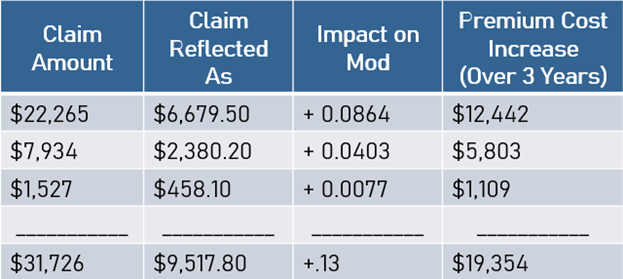

Now we will take a look at the same table but modified to show what would happen if these claims were Medical Only instead of Indemnity. It shows that over the course of 3 years, the total premium cost increase for these claims was an additional $19,354.

So – yes, you had claims, and your premium over the 3 years still increased regardless, but instead of increasing by $64,585 it only increased by $19,354.

Bringing It Full Circle

Whew, that was a lot. Let’s try summing it up in one place. So:

-

Get a Return to Work program in place: Get that employee back to work!

-

Getting them back to work quickly will keep the claim as “Medical Only”

-

“Medical Only” claims reflect as having a 70% discount

-

A lower $ claim has a better effect on your Experience Mod Calculation

-

Your Experience Mod is multiplied by your initial premium estimate to get a new premium estimate

To get a Return to Work Program in place, you should have a doctor’s note ready to go that indicates what you are trying to do and asks them the pointed questions that will help you accomplish it. Go ahead and get an idea of potential job duties together, and set expectations with your employees to let them know what will happen if they were to get injured. Ask questions and stay informed about your insurance program! If you need help with any of this or would like a doctor’s note template, please contact us and we’ll be happy to assist.

About the Author

Ruthie Lile is an Adventure and Entertainment Risk Consultant on the Granite Insurance team. She has a niche focus in the river operator industry but works with all adventure and entertainment operators that fit Granite Insurance’s programs. In her previous life, Ruthie herself was an operator in the outdoor adventure world, which gives her understanding and insight into running an operation and into employing risk mitigation strategies. Her passion is to educate and support her client partners, as is the mission of the entire Granite Insurance team. Granite Insurance serves 225 Adventure and Entertainment clients across the nation and offers all insurance lines pertinent to the adventure industries we serve, including General Liability, Property, Inland Marine, Commercial Auto, Participant Accident, and Worker’s Compensation among others.

Ruthie can be reached by email at rlile@graniteinsurance.com.