By: Pat Tabor, Swan Mountain Consulting

When most Outdoor Recreation Companies (ORCs) think risk management they envision insurance, waivers and litigation due to accidents. In addition to the traditional areas of exposure related to injury in the provision of service, the failure to perform to expected customer outcomes has created a whole new form of exposure! A comprehensive risk management program contemplates the integration of service contract management and a greatly expanded view of a traditional risk management program.

Do you use any form of service contract?

If not, consider:

- Largest growth in potential customer conflicts in last 5 years is not in traditional risk management arenas but rather in the failure of ORC to meet the expectation of a customer

- Uptick in following:

- Request for partial or full refund upon conclusion of service

- Stop payment request to credit card company

- Poor service reviews and bad ratings on advisory sites or threat of such if demands aren’t met

- Complaints filed with agencies against permit holder, e.g., USFS, BLM, NPS

Developing and implementing a well-designed service contract including “mini-versions” for short duration services will go a long way in protecting an ORC from these emerging threats.

Is your risk management system comprehensive?

When most ORCs think of a customer injury risk management program, the belief is if you have a well-written waiver, insurance and know of a good litigation attorney, your bases are covered. However, this is proving not be enough in this ever growing litigious environment we find ourselves in. Best-in-class operations design their risk management systems to be comprehensive, ensuring rigor in planning and execution and preparedness for the inevitable.

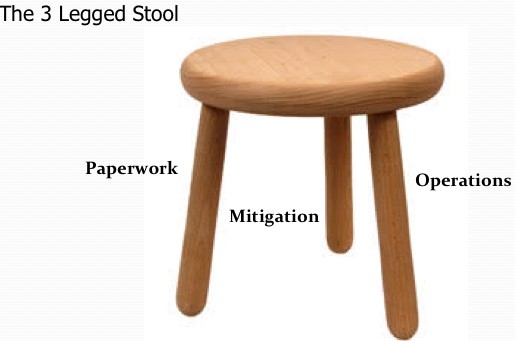

Such a comprehensive program would have three main elements to its construct best depicted as three legs of a stool:

Here’s what a sound system should include:

-

Leg 1 – Operations: Make safety a priority; train not only to do job, but to do it safely, and train employees on risk management issues and what to say/not to say as well as practice what to do in an emergency, and post accident triage.

-

Leg 2 – The paperwork: Use of legal forms make sure employees know what they are and how they work; your contracts and waivers must be integrated; make sure you document what you do, namely: equipment/stock inspection, maintenance, training, employee/animal isolation or correction, research; Finally design and implement a records management and retention policy.

-

Leg 3 – Mitigation: manage all the elements of insurance including: brokers versus underwriters, policy construction and managing insurance cost the right way versus the wrong way; consider your legal entity structure to see if you are insulated from law suits, and there is protection of assets and estate; design and implement a system for managing incidents, and; make sure you have the right legal team.

If your system is weak in any of the three major components then…

SYSTEM COLLAPSE!

SYSTEM COLLAPSE!

So how does your company fare? The best place to start is to do a self-assessment.

Take the Risk Management Thoroughness Assessment

And if you do find you are coming up short, where can you turn for help? AO has great resources- to start, ask fellow members for referrals in insurance and law, and consider the use of an independent risk consultant or industry expert to “audit” your system.

About the Author:

Website: www.swanmountainconsulting.com

Pat consults with companies on strategic planning, performance improvement, valuations, buy/sell, leadership development and other specialized areas of consulting focused on the outdoors recreation industry.