By: Ruthie Lile, Granite Insurance

Operators have had an interesting first half of the season. Hiring is a mess – everyone is understaffed and hourly wages are being driven up for a multitude of reasons, one being as an effort to attract potential employees. At the same time, visitation is high and many operators are running at max capacity to keep up with the demand. Experiences vary by industry and business location, but many are above expected on sales and are above expected on payroll costs. The way you handle (or fail to handle) the gap between your expected and actual performance numbers could have a big effect your off-season finances.

Adventure Operators who may benefit from reading this article:

-

If you have an “auditable” General Liability policy, and your YTD sales are either significantly greater or lower than you anticipated them to be.

-

If you have a Worker’s Comp policy, and your YTD payroll is either significantly greater or lower than you anticipated it to be.

-

If you want to better understand these types of insurance policies and how they work.

-

If off-season cash flows can be tight for you.

What type of policy do you have?

General Liability – Auditable Policy

We all know how the concept of an “audit” works, right? In General Liability insurance, you provide an estimated amount of sales at the beginning of your policy period, and then at the end of your policy period you true-up to your actual amount of sales. If by the end of your policy period you ended up with higher sales than you had initially estimated, you will likely owe additional premium to make up for that difference. (Depending on the size of that bill, it can cause a strain on your off-season finances. Our goal with this article is to help you reduce or eliminate that large end-of-the-season bill.) If by the end of the policy period you ended up with lower sales than you had estimated, you may have a partial premium refund coming back to you. This is the concept of an auditable policy.

General Liability – Non-Auditable Policy

Some General Liability policies are auditable, and some are not. It just depends on your carrier. If you have a non-auditable policy, and you end up with higher sales than you had estimated, you won’t receive a bill for additional premium. On the flip side, if you end up with lower sales than you had estimated, you won’t receive a refund for the overpayment of premium. Sometimes you win, and sometimes you lose. It’s a bit of a gamble.

Worker’s Comp – Always Auditable Policies

It’s similar on the Worker’s Comp side, except it’s based on your payroll instead of your sales and all Worker’s Compensation policies are auditable. So you’ll provide an estimated payroll amount at the beginning of your policy period, and then at the end of your policy period you true-up to your actual amount of payroll. If by the end of your policy period you ended up with higher payroll than you had initially estimated, you will likely owe additional premium to make up for that difference. Again, depending on the size of that bill, it can cause a strain on your off-season finances. If by the end of the policy period you ended up with lower payroll than you had estimated, you may have a partial premium refund coming back to you.

The Solution

General Liability – Mid-Term Sales Revision

If you have an auditable General Liability policy, and your sales are either looking significantly greater or lower than your initial estimate, you might consider doing a mid-term sales revision if your insurance carrier and agent will allow it. By the time you’re halfway through your season, you can have a much better indication of where you will end up.

I’m a visual learner, so I put together some images that will help explain how this works. Here’s an example of how your General Liability premium could end up if you didn’t make a mid-term revision. In this example, your initial sales estimate was $1M, but at the end of the year you actually ended up with $1.4M in sales and so were stuck with a large $12,000 premium bill at the end of your year:

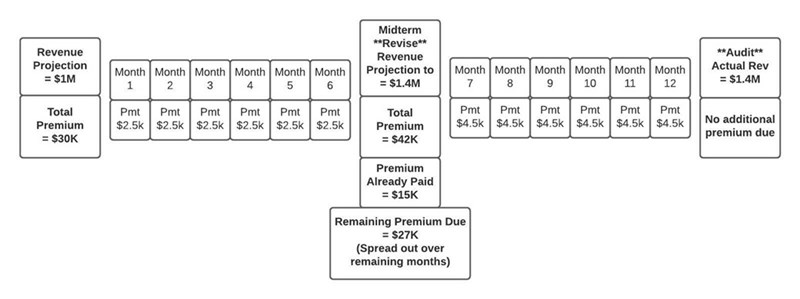

Here’s how the same situation might play out if in the middle of your policy period, you decide to update your sales estimate to something more accurate. By doing a mid-term sales revision, you spread the remaining premium due out over the remaining six months instead of being stuck with one large bill at the end of it:

Worker’s Comp – Mid Term Payroll Revision

Using the same concepts provided above for a General Liability policy, I’ll show an example of how a mid-term revision might affect your Worker’s Comp policy, premium, and end of the season cash flow.

Here’s an example of how your Worker’s Comp premium could end up if you didn’t make a mid-term revision. In this example, your initial payroll estimate was $300K, but at the end of the year you actually ended up with $450K in payroll and so were stuck with a large $15,000 additional premium bill at the end of your year:

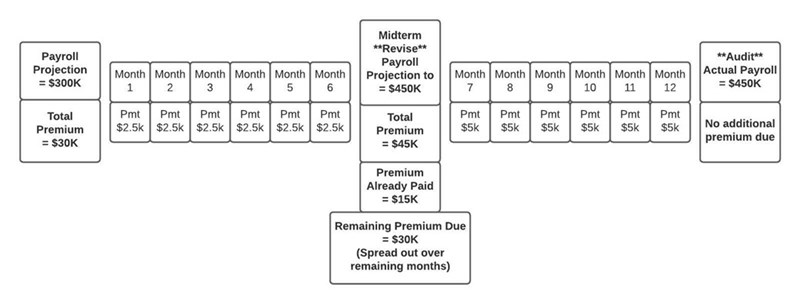

And here’s how the same situation might play out if in the middle of your policy period, you decide to update your payroll estimate to something more accurate. By doing a mid-term payroll revision, you spread the remaining premium due out over the remaining six months instead of being stuck with one large bill at the end of it:

A note:

Quick disclaimer before we wrap up – the premium numbers and rates used above are no indication of what your own premiums or rates might be. Rates vary vastly by state, by industry, and by about a million other factors. We chose round numbers that could work well in a 12-month breakdown!

About the Author:

If you’d like any more guidance on this topic or have questions about your insurance program, we’re happy to help. Our Granite Insurance team specializes in comprehensive insurance and risk management programs for adventure operators around the nation, and we have a passion for providing education. Let us know what we can do for you by contacting Ruthie Lile at rlile@graniteinsurance.com, and we look forward to seeing you at the America Outdoors Conference in December!